What Makes Our Learning Platform Special

Multiple Device Access

Our learning platform is in tune with every electronic device and our video lectures, study material can be accessed on any electronic device- a laptop, a tab, phone or even a home computer. Working online has inculcated in us the role of multi tasker.

Strict Time Frames

As we believe that time is free but priceless too, we are strictly committed to our time frames and finish the syllabus on time as we believe that valuing time is utmost important to crack this competitive exam.

Social Distancing Learning

2019 taught us the value of maintaining social distance and be covidient in our habits. It also taught us that learning can be operated through any platform, from anywhere if the right content is supplemented to your mind. You can now study anytime as per your convenience and work schedule with our prerecorded lectures and accessible devices while maintain social distancing.Our Story

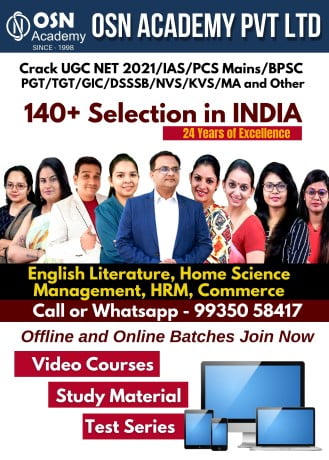

Our Achievements

We are driven by values

Dr. Anurag Agarwal

MA( English), NET, Ph.D, MBA

Director & Co Founder, OSN Academy

Core Features of Courses

Choose out of 10+ mentors. Trusted by 50k+ users. Industry experts and top professors.

High Quality Video

Lectures

Our video lectures are prepared with a vision to serve the exemplary information to our students covering every unit in all the subjects as we envision to prepare students to qualify their examination in the very first attempt. Video lectures are not only embedded with good resolution but with enriched content also which students can watch and understand with great clarification.

Premium Quality Study Material

The importance of study material of instructional material is to improve students’ knowledge and abilities and skills to broaden their thinking level. We believe that good quality study material not only enriches one’s ability to learn everything but to achieve success also. As NET Exam is divided into two papers: Paper 1 (General Paper/Teaching and Research Aptitude), and Paper II (Subject related papers),

Unlimited Practice Questions & Mock Tests

For the things we have to learn before we can do them, we learn by doing them.” ― Aristotle This famous quote puts emphasis on practice and so we believe that not only practice makes perfect but perfect practice makes perfect. Our full length Mock Tests and quizzes assure that practice is in right direction. Aiming to provide the similar spirit of exam to the students, our Mock Tests are designed on the basis of latest exam pattern.

Remedial Sessions

Building time into time for self-reflection is equally important as practice and preparation. We conduct remedial classes with special focus on self-reflection. To avoid repetitive errors and clarification of any difficult concept for our students who prepare rigorously and find doubts, our instructors are always a step ahead to help them and provide them remedies to overcome their areas where they lack.